Technology selection

Technology selection

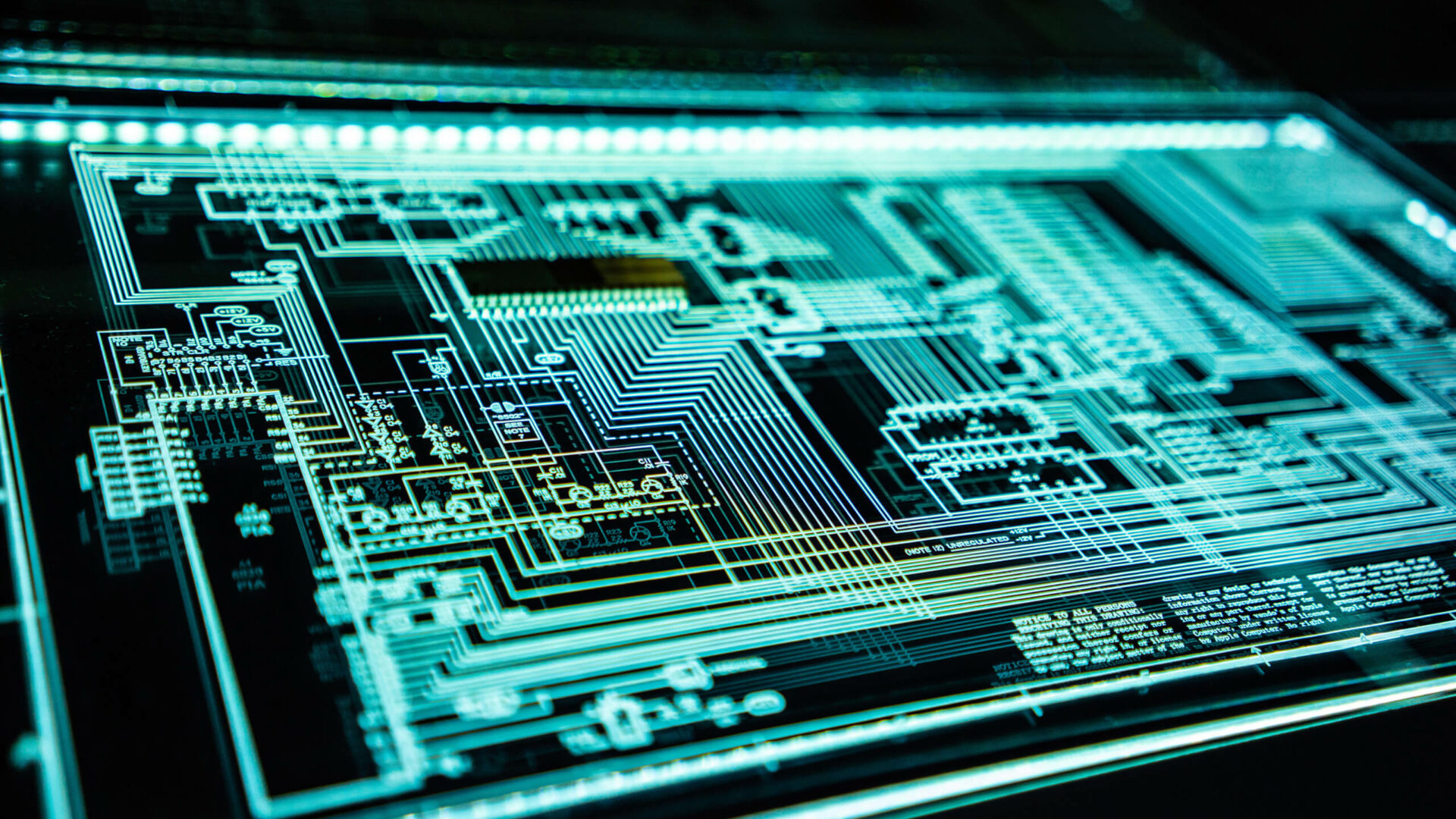

The right treasury technology can future-proof your processes and unlock powerful business benefits. We apply our knowledge to develop a treasury technology roadmap that delivers maximum returns from your investment in treasury transformation today and in the future.